In India, WhatsApp recently allowed payments, and to promote the transfer of funds, the function relies on the Unified Payments Interface (UPI) platform of the region. So, you should use WhatsApp to conduct financial transactions with your friends/relatives if you are in India, and it’s just as easy as it comes. Here’s how to get launched on WhatsApp UPI PAYMENTS.

About UPI Payments On Whatsapp:

After such a wait time of 2 years, WhatsApp UPI Payments was being released in India. In 2018, the Facebook-owned chat application first suggested the possibility of launching the payment function in India, but it took the team 2 years to get NPCI approval. In order to take over the major payment applications in India, like Paytm, PhonePe, Google Pay and many others, WhatsApp also introduced the Payments option.

With UPI, India has built something truly unique and has been opened up a lot of possibilities that are the bedrock of the Indian economy for small and medium enterprises. The first country to do something like this is India. I am happy that we have been able to sustain this initiative and cooperate to further achieve a much more digital India. “I would like to thank all of our collaborators who made it happen,” Facebook CEO and co-founder Mark Zuckerberg had said about the launch.

How to created WhatsApp Payments :

Users first have to add your bank account to that same system to get started with transactions on WhatsApp. UPI operates mainly with your mobile number, and in all main banks in India, the services work. The greatest thing is that you’ll be allowed to be using the payments feature inside WhatsApp even though you do not have a UPI account that will be created with your bank, as it will build a UPI ID for you. Here’s what you’d like to be sure of:

- First opens WhatsApp from the application drawer or the home page.

- Find the menu for the activity overflow (3 vertical dots in the upper right-hand corner).

- Select the Payment option.

- Click Add a new method of payment.

- Pick Agree and keep getting started.

- From the list, pick your bank name. It should be your main UPI account, preferably.

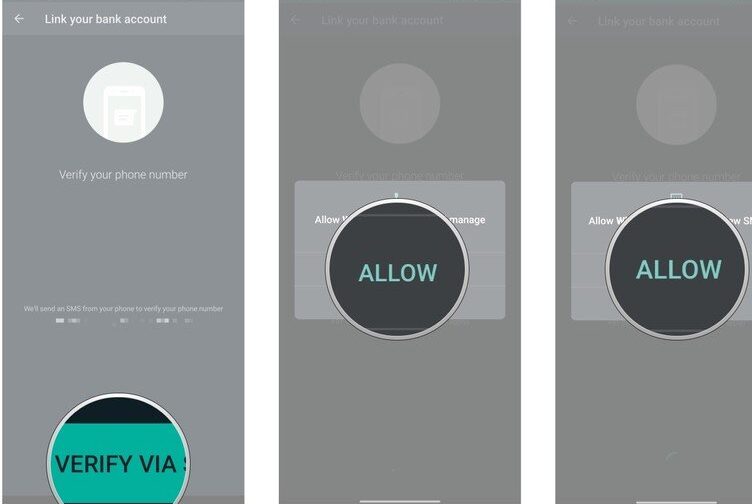

- Your contact information will need to be checked now. Please ensure the WhatsApp number you are using is also the same mobile number where your bank account has registered a bank account. To configure your bank account, Touch Confirm via SMS.

- Hit Enable WhatsApp to check that perhaps the Mobile network is the one in which your account is registered in.

- To configure your account, click Allow though for WhatsApp to submit messages.

- For your bank, WhatsApp will indeed check and pulls up all accounts associated with your mobile number. To complete establishing payments, pick one that you would like to use.

- To complete creating WhatsApp Pay, click Done.

- The payment form specified on the payment page can now be seen.

How to money sending and receiving it through WhatsApp:

It is really simple and clear to send and receive money that WhatsApp. The payment alternative exists in the chat window immediately, and exchanging money is as smooth as it can get:

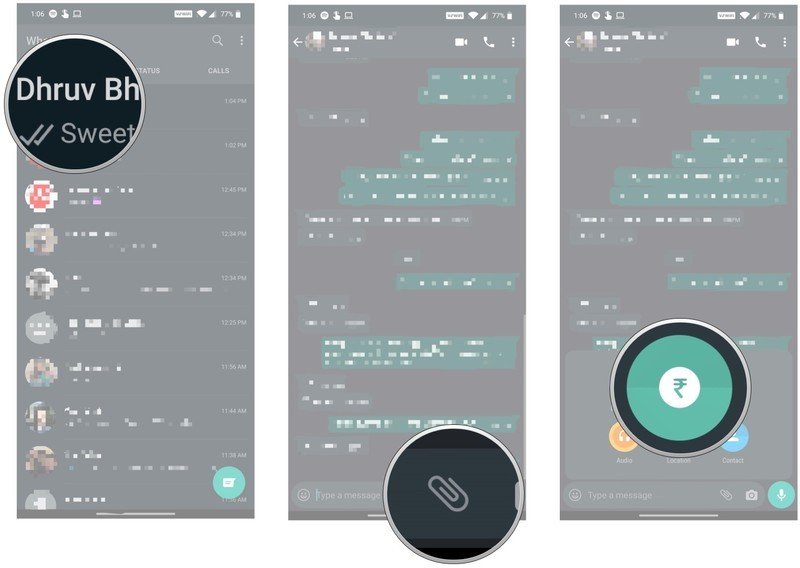

- Pick the personal contact to whom you wish to transfer cash.

- Pick the clip button in the discussion pane.

- Select the Payment option.

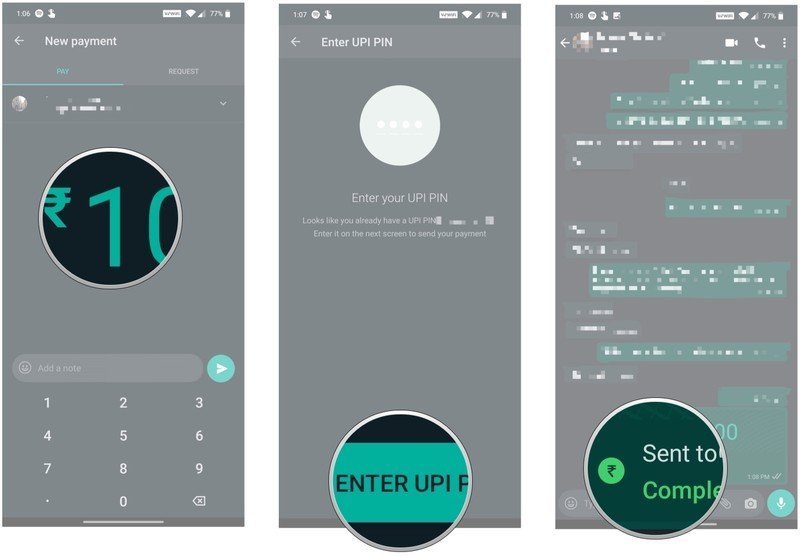

- Choose the number you’d want to give (you should add a note as well).

- Type your Password for UPI.

- When the exchange is completed, you can see a confirmation message pop up right in the chat pane.

How can we use WhatsApp Pay:

In the sharing file menu, the “payment” option will be available. Once allowed, by accessing the window of the payment, users can transfer funds to selected person contacts. The WhatsApp Payment service operates on the UPI system and to sent or receive a payment, one does not need to have bank account information such as account number and IFSC code. The cash may even be submitted by the scanning of a QR code to someone who is not on your phone contacts.

WhatsApp has introduced the service in Brazil and India, but the feature will be possible in the future in Mexico, the UK, Spain and Europe. WhatsApp has collaborated in India with the five largest banks to facilitate UPI payments, along with ICICI Bank, HDFC Bank, Axis Bank, State Bank of India, and Jio Payments Bank.

Conclusion:

Payments are developed with a broad collection of protection and privacy rules, including the entry of a private UPI Password for each payment, much like any WhatsApp feature. WhatsApp transactions are also available for users with the new versions of the iPhone and Android applications. If you have any Questions comment in the below section.